Tidepoint Construction Group Fundamentals Explained

Wiki Article

Some Of Tidepoint Construction Group

There are a lot of things that can gain from a fresh layer, from cupboards to stairwells to an accent wallresearch which shades work best where. Light colors make little rooms look larger, so brighten up bathrooms as well as smaller sized areas with those. Make sure to consult with an expert on which sort of paint to utilize prior to purchasing, as some are much less susceptible to mold and mildew and mildew if used in a shower room. https://peatix.com/user/18490590/view.

Invest in ADA-compliant accessories like toilet paper holders as well as towel bars that not just include to the appearance of your residence however the safety of it. Additionally, points like motion-activated exterior lights are not just energy-efficient but can hinder intruders from entering your home. While numerous presume improvement is just useful from a cosmetic point of view, there are a handful of various other benefits that take place from maintenance, remodels and also constant repair services specifically why there are numerous programs dedicated to investing and loaning money towards it.

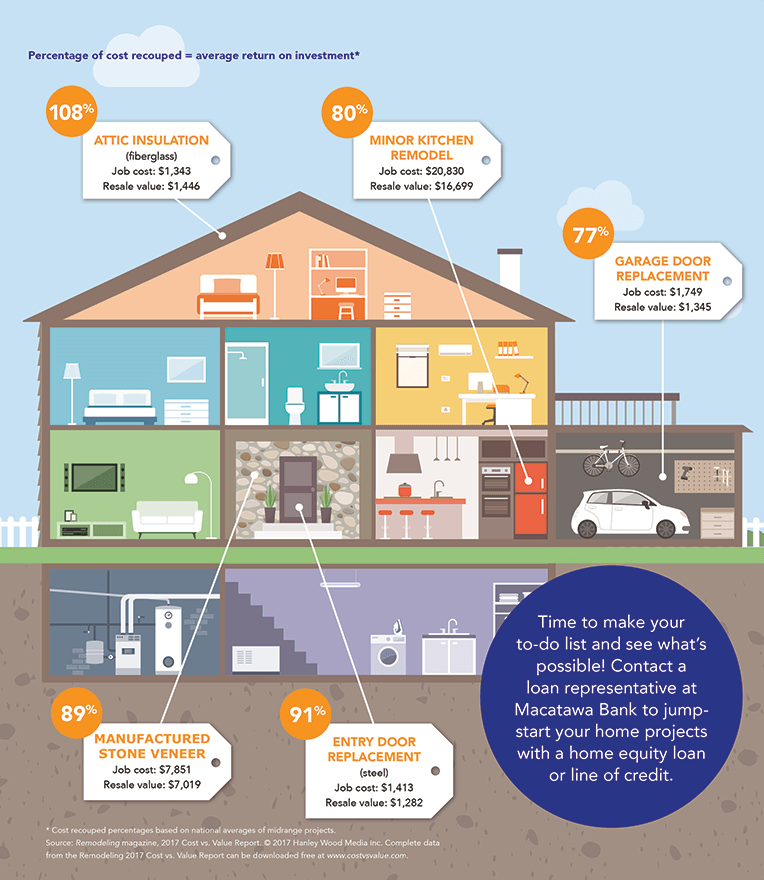

Although you might be forking up money at initially, buying high-grade products upfront will certainly enable less costly and also undesirable repair services along the road. Comparable to the above factor, purchasing upgrades can increase the resale worth of your home ought to you plan to market in the future.

Improvements aid to avoid these kinds of problems before they occur and also can also make living conditions better for your hairy good friends . Total convenience and livability are paramount to your psychological wellness as well. A fresh coat of paint or a newly crafted home gym can foster an uncluttered home and mind.

How Tidepoint Construction Group can Save You Time, Stress, and Money.

Are house repair work or upgrades tax insurance deductible? If so, what house enhancements are tax obligation insurance deductible? In other words, residence enhancement tax credit histories are a dollar-for-dollar reduction of tax obligations and reductions are decreased by how much cash you make per year.

It ultimately boils down to what kind of remodel you're finishing and whether it's identified as a repair service or an improvement. is any kind of modification that recovers a home to its initial state and/or value, according to the internal revenue service. Home fixings are not tax insurance deductible, except in the case of home workplaces and also rental buildings that you possess more to come on that particular later on in this guide.

is any kind of modification that raises the value of your house. According to Tax, Slayer, instances of improvements include including a new driveway, a new roof covering, brand-new siding, insulation in the attic, a brand-new septic system or built-in home appliances. Residence improvements can be tax reductions, yet some are only deductible in the year the house is marketed.

Facts About Tidepoint Construction Group Revealed

If you're unclear whether a fixing or renovation is tax obligation deductible, get in touch with a local tax obligation accounting professional who can address your questions concerning declaring. Please keep in mind house enhancement loans aren't tax obligation deductible since you can not subtract rate of interest from them. If this relates to you, quit reviewing right here. Instead, focus on where you can obtain the very best return when selling your residence with these pointers.

The solar credit history will stay till 2019, and afterwards it will be decreased yearly via 2021." Nevertheless, placing solar energy systems on new or current homes can still cause a 30% credit rating of the overall price of installation. This credit is not limited to your main home and also is also available for recently created residences.

Tax Deduction Same visit here Year Tax-deductible house improvements connected to clinical treatment are commonly hard to find by. If you intend on aging in place, these deductions may relate to you completely. You can include costs for clinical tools mounted in your house if its major objective is to give treatment for you, your partner or a reliant.

Repairs made straight to your workplace Improvements made directly to your workplace Repairs made to various other components of the house (partially insurance deductible) Some enhancements made to various other parts of the house (partly deductible) Repairs that directly influence your business area can be subtracted completely (e. g., healing a damaged home window in your office).

The Main Principles Of Tidepoint Construction Group

If your office occupies 20% of your house, 20% of the remodelling expense is tax-deductible. Home additions Hilton Head.

8% Rating significant resale worth as well as some great R&R time by adding a wood deck to your yard. Just make sure to include railings, pressure-treat the wood, and also secure it to safeguard it from the elements.

If it's also fashionable or as well tailor-made, it will likely estrange some purchasers when you prepare to sell.

Report this wiki page